are my assisted living expenses tax deductible

According to the IRS. As long as the resident meets the IRS qualifications see above all assisted living expenses including non-medical costs like housing and meals are tax deductible.

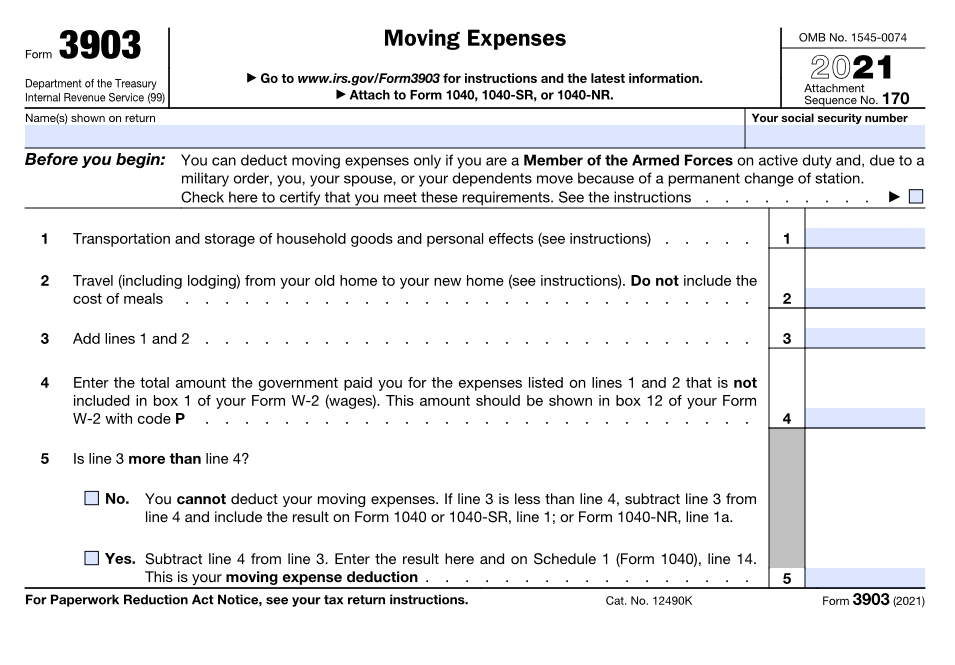

New Tax Twists And Turns For Moving Expense Deductions

The amount that you can deduct for tax purposes will differ depending on your particular situation.

. Some Assisted Living patients will be able to deduct the entire monthly. There are some medical expenses that will comprise a part of the assisted living fees and they will contribute towards a large portion of the residents assistance. On the other hand if Mom cannot get in and out of bed bath and eat by herself or if she is perhaps in the locked Alzheimers unit Dad will be able to use the assisted living facility costs.

But did you know some of those costs may be tax deductible. There are certain expenses that are prohibited from being tax deductible. Not all assisted living costs can be deducted but if you or your loved one calls an assisted living community home you may be able to deduct some service.

The IRS will have requirements so the family members can assisted living home expenses nursing home expenses and also treatments for Alzheimers disease. For tax purposes assisted living expenses are classified as medical expenses. As long as the resident meets the IRS qualifications see above all assisted living expenses including non-medical costs like housing and meals are tax deductible.

Medical expenses including some long-term care expenses are deductible if the expenses are more than 75. Tax deductions are the perfect example. Medical expenses generally make up at least a portion of the monthly service and entrance fees at assisted living communities.

If you your spouse or your dependent is in a nursing home primarily for medical care then the. Assisted living expenses may also be deductible if an individual requires supervision due to a cognitive impairment such as Alzheimers or another form of dementia. Yes if you live in an assisted living facility you can generally write off a number of medical expenses included in the fees for assisted living as well as Skip to content getperfectanswers.

The deductions are documented on Schedule A of your Form 1040 Federal tax return under. Chronic Illness and Tax Deductible. Yes in certain instances nursing home expenses are deductible medical expenses.

According to the 1996 Health Insurance Portability and Accountability Act HIPAA long-term care services may be tax deductible as an unreimbursed medical expense on Schedule A. If you or a loved one is living in an assisted living facility there may be some expenses that qualify as tax deductible. If a loved one needs to move into an assisted living facility to recover from an illness or an injury and requires only observational or custodial care a portion of that care may be.

For example housing fees are not tax deductible unless your loved one resides in an assisted. If you or your loved one lives in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction. Any long-term care services such as assisted living nursing home care and in-home skilled nursing services can be deducted as medical costs under certain circumstances.

What Assisted Living Expenses are Tax Deductible. TurboTax also notes that assisted living expenses can be tax deductible for individuals needing supervision because of cognitive impairment such as dementia or.

Is Assisted Living Tax Deductible Medicare Life Health

How To Pay For Nursing Homes Assisted Living

Deduct Expenses For Long Term Care On Your Tax Return Kiplinger

Tax Deductions For Assisted Living Medicaid Asset Protection Trusts And Estate Planning Lawyer Greensboro Nc

Are Assisted Living Expenses Tax Deductible Medical Expense Info

Tax Deductibility Of Assisted Living Senior Living Residences

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

How To Deduct Home Care Expenses On My Taxes

Is Assisted Living Tax Deductible Five Star Senior Living

Important Tax Deductions For Assisted Living Veteranaid

2022 Assisted Living Costs And Pricing By State

List Of Assisted Living Tax Deductions Retirement Savior

Publication 502 2021 Medical And Dental Expenses Internal Revenue Service

Is Assisted Living Tax Deductible What You Can Claim 2019

2022 Assisted Living Costs And Pricing By State

Can I Claim Medical Expenses On My Taxes H R Block

10 Tax Deductions For Seniors You Might Not Know About

![]()

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

Tax Deductibility Of Assisted Living Senior Living Residences